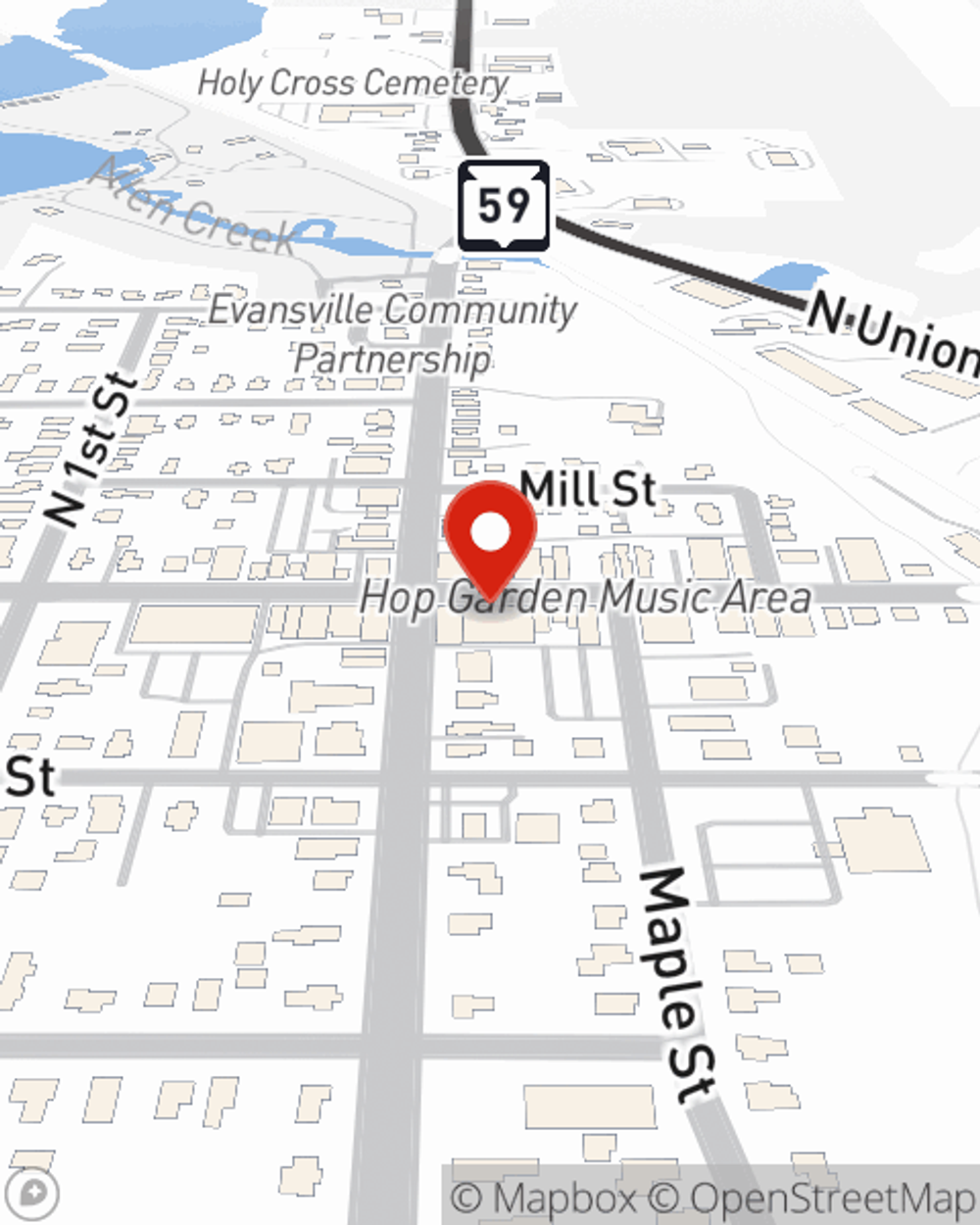

Business Insurance in and around Evansville

Researching coverage for your business? Search no further than State Farm agent Diane Berg!

Insure your business, intentionally

Coverage With State Farm Can Help Your Small Business.

Being a business owner isn't easy. You want to make sure your business and everyone connected to it are covered in the event of some unexpected mishap or problem. And you also want to care for any staff and customers who get hurt on your property.

Researching coverage for your business? Search no further than State Farm agent Diane Berg!

Insure your business, intentionally

Strictly Business With State Farm

Protecting your business from these potential mishaps is as easy as choosing State Farm. With this small business insurance, agent Diane Berg can not only help you design a policy that will fit your needs, but can also help you submit a claim should a problem like this arise.

Take the next step of preparation and contact State Farm agent Diane Berg's team. They're happy to help you investigate the options that may be right for you and your small business!

Simple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Diane Berg

State Farm® Insurance AgentSimple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.